Americans over the past 35 years have had their effective incomes dramatically eroded due to the surging costs of college, health insurance, housing and transportation, according to a new study from the Manhattan Institute.

From The Manhattan Institute, "The Cost-of-Thriving Index: Reevaluating the Prosperity of the American Family" (via The Washington Post):

A dramatic divergence between data and experience is confounding America’s policy debates. The data seem to show that households have attained unprecedented prosperity, and wages have (at worst) held their own against inflation, or (at best) risen much faster than prices. By conventional measures, material living standards everywhere in the income distribution are at all-time highs, and technological progress continues to improve them. Yet many jobs able to support a family in the past no longer do. Millennials are in worse financial shape than were those of Generation X at the same age, who themselves had fallen behind the baby boomers. The stories appear irreconcilable.

The explanation is this: inflation does not measure affordability. Key assumptions built in to inflation indexes for the purpose of measuring the underlying, economy-wide upward pressure on prices are different from, and often counter to, the key assumptions necessary for assessing the economic choices and constraints faced by households. When analysts use inflation adjustments to compare household resources over time, they have chosen the wrong vantage point, and their view is obscured.

Economists and families see three things differently:

•Quality Adjustment. Products and services that rise substantially in price but in proportion to measured quality improvements can become unaffordable, while having no effect on inflation.

•Risk-Sharing. New products and services can increase costs for the entire population yet deliver benefits to only a very small share, while having no effect on inflation.

•Social Norms. Society-wide changes in behaviors and expectations can alter the value or necessity of a good or service, while having no effect on inflation.

As an alternative to inflation adjustment, this paper proposes the development of a “Cost-of-Thriving Index” (COTI) that tracks the cost of a basket of major items that a family of four would likely seek to buy. A comparison over time between the cost of that basket and a median weekly wage indicates whether economic trends are easing or compounding the challenge of making ends meet.

In 1985,[2] the COTI stood at 30—it would require 30 weeks of the median weekly wage to afford a three-bedroom house at the 40th percentile of a local market’s prices, a family health-insurance premium, a semester of public college, and the operation of a vehicle. By 2018, the COTI had increased to 53—a full-time job was insufficient to afford these items, let alone the others that a household needs.

Contrary to what our ruling oligarchs tell us, it's not just in our heads that a man today has to work two jobs to make as much as his father made 30 years ago (on top of being systematically discriminated against).

"Popular perception is correct," lead author Oren Cass said on Twitter. "In 1985, the typical male worker could cover a family of four's major expenditures (housing, health care, transportation, education) on 30 weeks of salary. By 2018 it took 53 weeks. Which is a problem, there being 52 weeks in a year."

More from the Manhattan Institute:

Products that spread risk offer everyone value in formal economic terms, but only those who suffer the risky outcome receive a tangible benefit. If health-insurance premiums rise because conditions present in 1% of families can now be treated with new and extremely expensive procedures, prices have not increased for inflation purposes. But 99 out of every 100 households that have to pay more for their insurance will never experience any perceptible change in the quality or quantity of their health care. Good analyses of economic well-being are usually careful to focus on outcomes at the median, rather than the mean; yet when it comes to the asserted improvement in material living standards associated with higher health-care spending, the gains are present only on average and are concentrated in a very small fraction of the distribution.

Thus, while the average family health-insurance premium has risen from $5,791 in 1999 to $18,764 in 2017, median spending on actual health care for a family of four (two adults, two children) has risen from $2,122 to $4,380. That is, the typical household is paying almost $13,000 more to get health care that costs $2,200 more (Figure 4). The family is, in fact, better protected from a wide range of rare conditions, but both their material living standard and financial flexibility may be far lower.

This is why a lot of Trump's rhetoric (and Obama's in the past) seems to fall flat when he boasts about how strong our economy is.

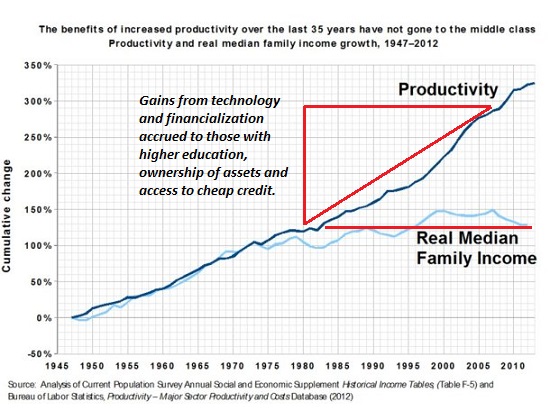

Our economy seems to have shifted into a kleptocratic looting operation with the end of Bretton Woods in 1971 when Nixon ditched the gold standard. Our ruling oligarchs have been swimming in cheap money ever since while the middle class has been drowning due to inflation.

There's no doubt mass immigration on top of suppressing wages has also played a huge part in the rising costs of college, health insurance, housing and transportation:

Follow InformationLiberation on Twitter, Facebook, Gab and Minds.

Related Articles:

More Americans are getting priced out of purchasing homes than ever, as soaring prices continue to outpace wages, according to a new report.

If you have a good paying job, you should probably try to hold on to it as hard as you can, because those types of jobs are steadily becoming rarer.

The main problem with the US economy is that globalism has been deconstructing it. The offshoring of US jobs has reduced US manufacturing and industrial capability and associated innovation, research, development, supply chains, consumer purchasing power, and tax base of state and local governments. Corporations have increased short-term profits at the expense of these long-term costs. In effect, the US economy is being moved out of the First World into the Third World.

This wasn’t supposed to happen. During the relative economic stability of the past few years, the middle class was supposed to experience a resurgence, but instead it has just continued to be hollowed out. The cost of living has risen much faster than wages have, and as a result hard working families all over America are being stretched financially like never before. Even though most of us are working, 59 percent of all Americans are currently living paycheck to paycheck, and almost 50 million Americans are living in poverty. In a desperate attempt to continue their middle class lifestyles, many Americans have been piling up mountains of debt, and it has gotten to the point where we have a major crisis on our hands.