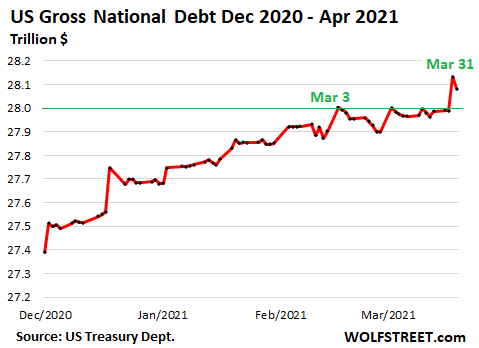

It finally happened, that glorious moment, when, after teetering on the verge for weeks – for reasons we’ll get into shortly – the incredibly spiking US gross national debt, after kissing the line a couple of times for a moment, finally, and suddenly by a big leap, jumped over the $28-trillion mark, with a $143-billion leap in one day on Wednesday, March 31, following some big Treasury sales. It gave some of that up on Thursday as some bonds matured. And it now amounts to $28.08 trillion, as per US Treasury Department on Friday.

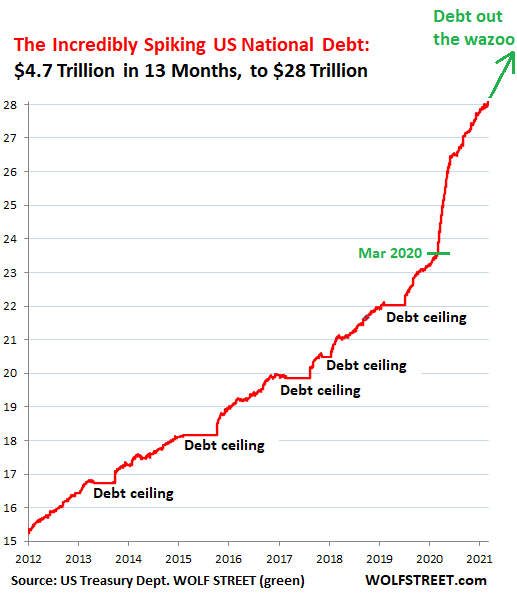

The US gross national debt has now spiked by $4.7 trillion in 13 months since the end of February 2020, in the days before this show started.

The flat spots in the chart are the visual depictions of a charade unique to American politics, the periods when the debt bounced into the Debt Ceiling. Those were the days when everyone in Congress was still trying to hijack the Debt Ceiling law to get their favorite spending priorities!

If it looks like the trillions have been whizzing by a little less fast in recent months, that the growth of the debt has somehow slowed, that is correct.

The chart below magnifies the daily debt levels since December. On March 3, the debt level touched $28 trillion but only barely and just for one day, before backing off, and then kissed it again on March 17, only to back off again and remain tantalizingly close, but no cigar, until Wednesday, when it did the deed with one huge $148-billion leap:

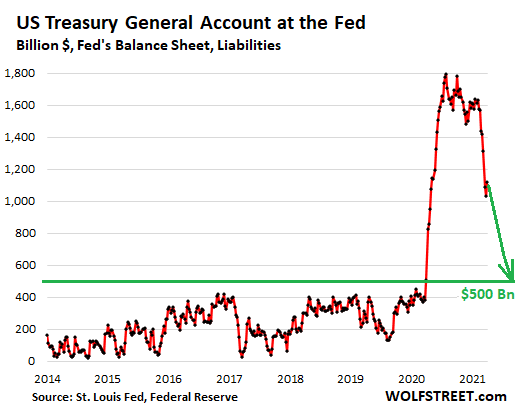

The reason for this slowdown in borrowing is that the government sold a gigantic amount of debt last spring, adding $3 trillion to its debt in a few months, and then didn’t spend all of it, but kept the unspent amounts in its checking account – the General Treasury Account or GTA — which ballooned to $1.8 trillion by July, from the pre-crisis range between $100 billion and $400 billion.

During the final months of the Mnuchin Treasury, it was decided to start spending down the balance in the checking account by borrowing a little less, and by early January, the GTA had dropped to $1.6 trillion.

Early on in the Yellen Treasury, the drawdown was formalized. In early February, a schedule was announced: the balance would be brought down by $1.1 trillion to $500 billion by June. And they’re now well into it.

The drawdown has the effect that the government spends money it doesn’t have to borrow at the moment because it already borrowed it last spring when the Fed was still monetizing essentially all of the borrowing. This has some implications for the markets.

The government’s TGA is at the Federal Reserve Bank of New York and is reported weekly on the Fed’s balance sheet as a liability (banks report deposit accounts as liabilities) because this is money the Fed owes the government.

In the two months since early February, the balance has plunged by $480 billion to $1.12 trillion. Over the next three months, it will plunge by another $620 billion:

During the six months through June, the government will spend $1.1 trillion that it doesn’t have to borrow because it already borrowed it a year ago and that the Fed monetized at the time. But this ends in June.

What does this mean?

Not having to borrow this $1.1 trillion of spending during the first half of 2021 is taking pressure off the Treasury market. And yet, despite that relief, the 10-year Treasury yield has surged to 1.72%.

By June, this pressure valve will close, and the government will borrow more, and the market will have to digest it, and there is a huge amount of new borrowing being lined up to fund the added spending. This will put further upward pressure on long-term yields.

The fact that the government is now spending the proceeds from debt sales a year ago that the Fed monetized a year ago has been adding liquidity to the economy and the markets – liquidity that had been stuck in the TGA – possibly adding to the craziness of the markets in recent months. But that will end in June.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.