The Organization for Economic Co-operation and Development (OECD) recently published a report showing how pension funds in OECD countries recorded a massive loss of approximately $2.5 trillion during the stock market meltdown in February through late March. Shortly, after that, central banks intervened with monetary cannons to rescue stock markets and other financial assets to avoid pension returns from going negative.

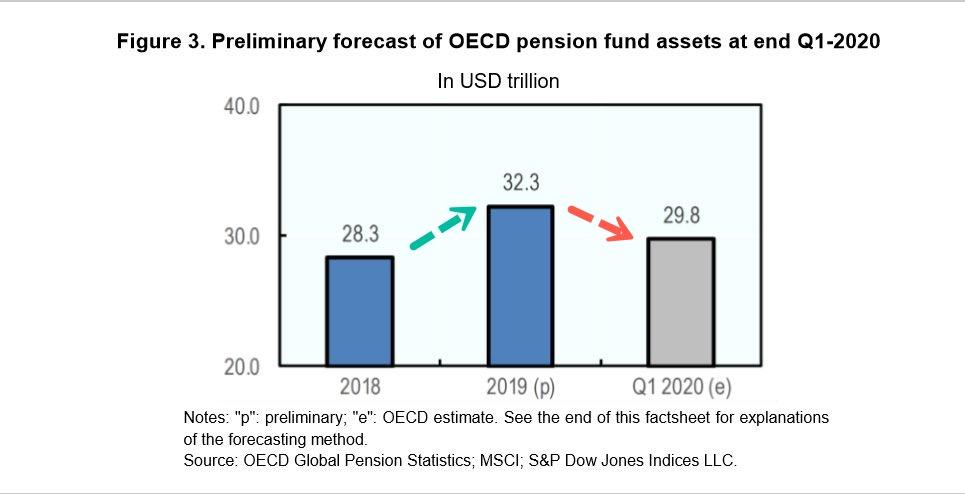

The spread of COVID-19 worldwide and its knock-on effects on financial markets during the first quarter of 2020 are likely to have reversed some of these gains. Early estimates suggest that pension fund assets at the end of Q1 2020 could have dropped to USD 29.8 trillion, down 8% compared to end-2019 [or about a $2.5 trillion loss].

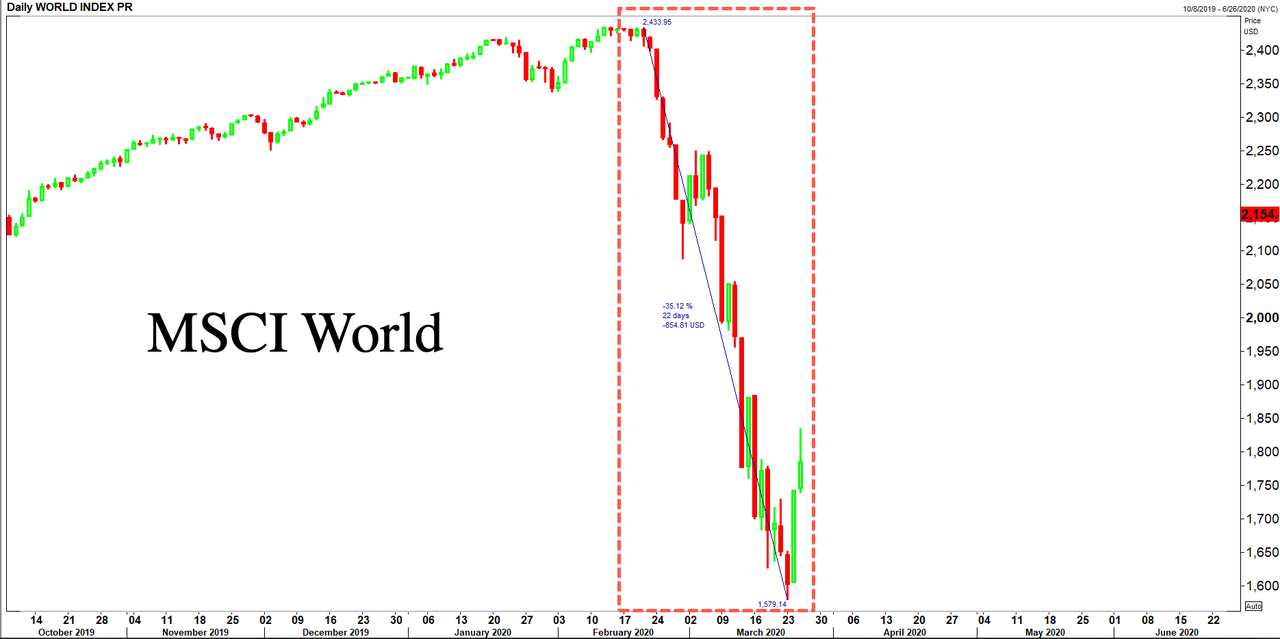

The drop in pension fund assets is forecast to stem from the decline in equity markets in the first quarter of 2020. Returns, inclusive of dividends and price appreciation, were negative on the MSCI World Index in the first quarter of 2020 (-20%), and between -11% and -24% on the MSCI Index for Australia, Canada, Japan, the Netherlands, Switzerland, the United Kingdom, the United States.

An increase in the price of government bonds that pension funds own could partly offset some of the losses that pension funds experienced on equity markets in Q1 2020. Some Central Banks, such as the Federal Reserve in the United States, cut interest rates in 2020 to support the economy. The fall in interest rates may lead to an increase in the price of government bonds in the portfolios of pension funds as the yields of newly issued bonds decline. - OECD

Bloomberg's Lisa Abramowicz pointed out in a tweet, "this report [referring to the OECD report] shows the massiveness of pension assets & points to why central banks are tethered to bailing out markets: social infrastructures depend on their not going down too much."

Abramowicz is 100% right. A significant drop in asset prices, if that is in equities, commodities, corporate bonds, etc., central bankers are quick to act by lowering interest rates and firing up the printing presses.

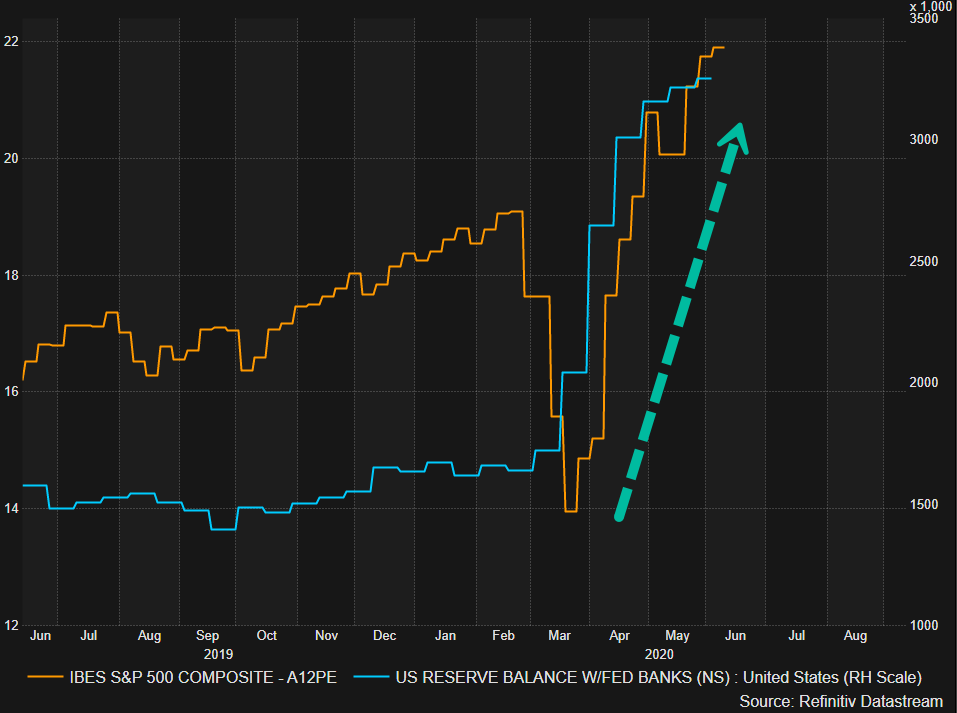

This was seen in March when the Federal Reserve and other major central banks unleashed monetary cannons to arrest volatility and hockey stick save asset prices.

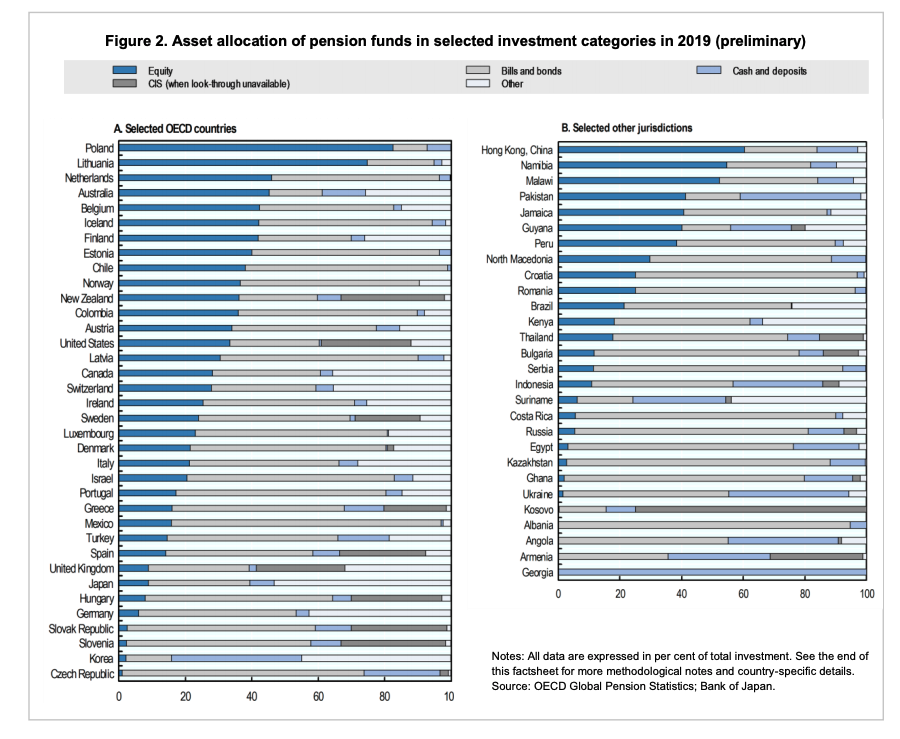

When it comes to the asset allocation of pension funds, the report shows many were invested in equities and bonds at the end of 2019. Pension funds held more than 75% of their portfolios in equities and bonds in about half of OECD countries. Several pension funds, including Lithuania and Poland, had equities allocation over 50% of total investments.

A question we should be asking is why so many pension fund asset allocations seemingly concentrated in just a few asset classes?

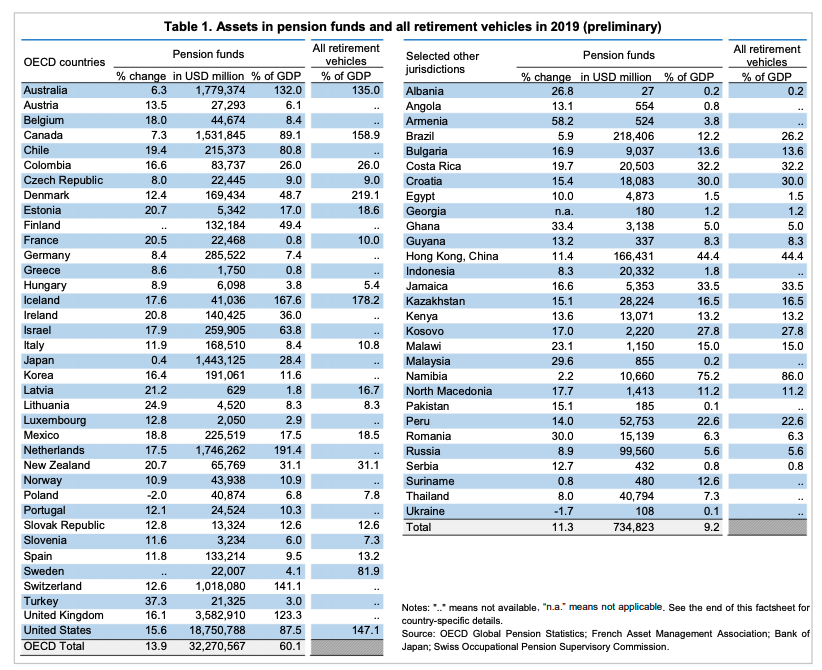

As far as size, pension funds held in OECD countries totaled $32.3 trillion in assets. The US has the most significant amount of assets in pension funds at the end of 2019 ($18.8 trillion), followed by the UK ($3.6 trillion) and Australia ($1.8 trillion).

Another question: who allowed these pensions funds to get so large and or too big to fail?

Pension fund size in relation to a country's GDP is a bit concerning. Assets in pension funds exceeded the size of the domestic economy in five countries: Australia (132%), Iceland (167.6%), the Netherlands (191.4%), Switzerland (141.1%), and the United Kingdom (123.3%). By contrast, pension fund assets were below 20% of GDP in 44 out of 66 reporting countries.

And don't even get us started about the pension situation in the US. We've basically written a book over the years on unfunded public pension liabilities for states amount to $4.9 trillion or $15,080 per person. Here are some good reads on the collapsing American pension system:

- "These States Have The Most Unfunded Public Pension Liabilities"

- "US Public Pension Funds Have Lost $1 TRILLION In Recent Weeks"

- "The Arrival Of The "Unavoidable Pension Crisis"

- "Worse Than 2008" - American Pension Funds Report Record Losses In Q1"

Abramowicz responded to a twitter user who was asking about pension obligations, and she said: "Agreed, but meeting those obligations becomes an even more difficult task if markets tank. There's a pension issue no matter what markets do, but it becomes much more acute if the funds generate negative returns for a sustained period."

It should be increasingly clear that the Fed's money printing is to stabilize financial asset prices -- no matter how bad the underline economy gets (mainly so pension returns don't go negative). The financial economy is getting bailed out at the expense of the real economy, already seen with record-high stock valuation, tens of millions unemployed, soaring wealth inequality, and social unrest.

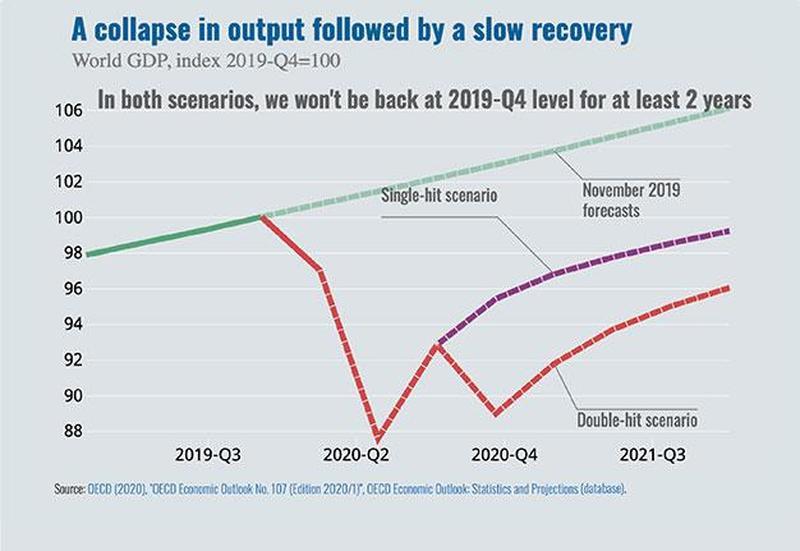

While investment performance of pension funds was strong in 2019 -- a separate OECD report outlines how a V-shaped recovery in the global economy is out of the question this year, suggesting some of these funds could generate negative returns for the foreseeable future.

Notable tweets from Twitter users who examined the OECD report:

Dont bail out pensions, Boomers riot.

— Kevin Michaels (@KevinMich1987) June 12, 2020

Do bail out pensions, Millenials and Genz riots.

What do? pic.twitter.com/jbKw43Uzk2

Central banks?

— anti-comuna (@nticomuna) June 12, 2020

Or the FED?

The majority of the pensions in europe do not need stockmarkets returns

But in the Trumptardland? pic.twitter.com/aYtAMFke4y

Prohibit Pensions from gambling in stock markets... pic.twitter.com/EY5LiH20l2

— J.M. Hamilton (@jmhamiltonblog) June 12, 2020

To sum up, central banks are in the game of supporting asset prices so pension funds can deliver positive returns -- if negative returns are seen, the Ponzi implodes and social unrest follows. However, social unrest has already begun -- despite the central bank induced V-shaped recovery in financial asset prices. What do central bankers do now?