According to the Treasury release, the U.S. also announced new penalties on a key Russian sovereign wealth fund, the Russian Direct Investment Fund, and its Chief Executive Officer, Kirill Aleksandrovich Dmitriev, a close ally of Russian President Vladimir Putin. The announcements marked the latest blow in the West’s financial retaliation against Russia following Putin’s invasion of Ukraine and are designed to shake an already staggering Russian financial system.

“The unprecedented action we are taking today will significantly limit Russia’s ability to use assets to finance its destabilizing activities, and target the funds Putin and his inner circle depend on to enable his invasion of Ukraine,” Treasury Secretary Janet Yellen said in a statement.

The U.S. and EU blocks on the Russian central bank’s assets will immobilize nearly half of Putin’s warchest, according to a Treasury spokeswoman. Roughly 13% of the central bank’s reserves are held in China, she said.

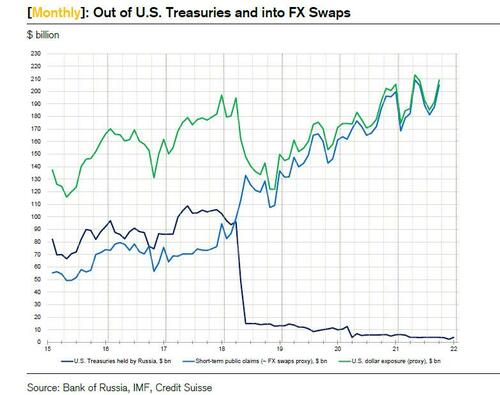

Putin’s warchest is an estimated $630 billion in reserves, the officials said, and the measures are aimed at blocking his ability to sell those to mitigate financial pressure domestically. Russia’s own data published in January shows that $100 billion of the reserves were held in U.S. dollars as of June, however as Zoltan Pozsar noted overnight, there is over $200BN in swaps.

The US move comes two days after the U.S., U.K., Canada and the EU said they would block major Russian banks from SWIFT, take steps to stop Russia’s central bank from rescuing the nation’s economy and move to seize Russian oligarchs’ yachts and residences in the West. The U.K. Treasury said earlier Monday it will act immediately to stop people and companies doing businesses with the Bank of Russia, the Russian National Wealth Fund and the Ministry of Finance. The moves to isolate Russia from the global economy came after an initial round of penalties failed to persuade Putin to withdraw his forces from Ukraine.

In consideration for those European nations who remain hostage to Russian gas exports, the U.S. separately issued a license allowing certain energy transactions with the central bank, a carve-out a senior administration official said is aimed at minimizing the fallout in Europe and energy markets. Still, it will take time for Russian institutions to figure out how to segregate energy transactions from other measures, the official said.

Commenting on the US sanctions, former State Department staffer Eddie Fishman tweets the following:

it looks like these are essentially blocking sanctions. (There are technical differences, but the effect is the same—"any transaction" with the CBR is prohibited.) The CBR will be unable to intervene in FX markets to prop up the ruble, full stop.

The US directive also applies to Russia's National Wealth Fund and Ministry of Finance. Consequently, the action renders ALL of the Russian government's rainy day funds inert. It is comprehensive. (SOEs aren't included, but their FX holdings aren't nearly as large.)

This is a sanctions action without precedent. As a result, the specific consequences aren't easy to predict with a high level of confidence. But the consequences will certainly be far-reaching. And it took a whole lot of courage for the US and Europe to take this step.

Meanwhile, as Bloomberg notes, the US is continuing to work with European Union partners to finalize the list of banks that will be cut off from the SWIFT system, a second senior administration official said. The list of banks will be finalized by the EU because SWIFT is under Belgian authority. U.S. officials are monitoring Belarus’s role in the Russian invasion, and that country will also face further consequences if it continues to aid and abet Russia, one of the officials said.

In response to the barrage of sanctions, the Bank of Russia acted quickly to shield the nation’s $1.5 trillion economy from the sweeping penalties, more than doubling its key interest rate to 20%, the highest in almost two decades, suspending equity markets and imposing some controls on the flow of capital.

The IIF's Elina Ribakova made the following comments in response to the BoR's actions:

2/ Capital controls:

— Elina Ribakova 🇺🇦 (@elinaribakova) February 28, 2022

- measures to prevent capital flight by non-residents (starting with a ban on divestment from fin. assets)

- 80% export proceeds

4/ Regulatory support measures (~900bn positive impact on bank capital)

— Elina Ribakova 🇺🇦 (@elinaribakova) February 28, 2022

- no mark to market

- no provisioning

- restructure debt

- release all capital buffers

- no open FX position for sanctioned banks

5/ Domestic payments systems are function. Domestic alternative to SWIFT and domestic alternative to Visa/Mastercard. pic.twitter.com/rpgLUTni5J

— Elina Ribakova 🇺🇦 (@elinaribakova) February 28, 2022

Meanwhile, calculating the capital flight out of the domestic banking system, Ribakova writes that individuals took out $10 billion (1 trillion RUB) in case from the Russian banking system in just the past few days:

Individuals took out more than 1 trillion (10bn) in cash from the Russian banking system in just over a few days. https://t.co/301bskzlBq

— Elina Ribakova 🇺🇦 (@elinaribakova) February 28, 2022

As reported last night, facing the risk of a bank run, a rapid sell-off in assets and the steepest depreciation in the ruble since 1998, policy makers banned brokers from selling securities held by foreigners starting Monday on the Moscow Exchange.

The ruble continued to plunge against the dollar, with the currency losing a third of its value in offshore markets at one point Monday, hitting an all-time low of 109 per dollar in Moscow before recovering some losses and was last trading around 98.

The announcements came as a Ukrainian delegation led by the defense minister began talks with Russian officials. Ukrainian President Volodymyr Zelenskiy has voiced skepticism that the talks, taking place on the country’s border with Belarus, would yield results but said he was willing to try if it meant any chance of peace.