One of the oddest and most mysterious relationships that emerged out of the collapse of FTX last year was Alameda Research’s unusual relationship with Farmington State Bank, one of the smallest, rural banks in the United States that came under the control of Jean Chalopin in 2020. Chalopin is best known as the chairman of Deltec, one of the main banks for Alameda Research – FTX’s trading arm that played a central role in its collapse — and still one of the main banks for the largest fiat-backed stablecoin, Tether (USDT). Chalopin had acquired control over Farmington via FBH Corp., where Chalopin was listed as executive officer. Interestingly, Noah Perlman, a former DOJ and DEA official who is now Chief Compliance Officer at Binance and the son of Jeffrey Epstein associate and musician Itzhak Perlman, was also listed as a director of FBH Corp and has never publicly explained his connection with this Chalopin-controlled entity.

As Unlimited Hangout reported last December, soon after its acquisition by Chalopin’s FBH Corp., Farmington “pivoted to deal with cryptocurrency and international payments” after decades upon decades of serving as a single branch community bank in rural Washington. Soon after its pivot into the crypto space, Farmington struggled to move money and sought approval to become part of the Federal Reserve system. It also changed its name from Farmington State Bank to Moonstone Bank. The approval of Farmington by the Federal Reserve has been deemed highly unusual and as having “glossed over Moonstone’s for-profit foreign interests.” Late last December, Eric Kollig, spokesman for the Federal Reserve, told reporters that he could not comment “about the process that federal regulators undertook to approve Chalopin’s purchase of the charter of Farmington State Bank in 2020.”

Just days after Farmington formally changed its name to Moonstone in early March 2022, FTX-affiliated Alameda Research poured $11.5 million into the bank, which was – at the time – more than twice its entire net worth. Moonstone’s Chief Digital Officer, Jean Chalopin’s son Janvier, later stated that the funding from Alameda Research had been “seed funding … to execute our new plan of being a tech-focused bank.”

Upon Alameda’s taking a stake in the bank, Jean Chalopin stated that this move “signifies the recognition, by one of the world’s most innovative financial leaders, of the value of what we are aiming to achieve. This marks a new step into building the future of banking.” Outlets like Protos have noted how unusual it is that a Bahamas-based company like FTX was “able to purchase a stake in a federally approved bank” without attracting the attention of regulators.Washington State regulators have stated that they were “aware” of Alameda’s investment in Farmington/Moonstone and defended their decision not to intervene or take further regulatory action.

Notably, the influx of new money into the remodeled Farmington was not exclusive to FTX/Alameda. A New York Times article on the matter noted that Farmington/Moonstone’s deposits – which had hovered around $10 million for many decades – quickly surged to $84 million, with $71 million coming from only four new accounts during this same relatively short period in 2022.

As Unlimited Hangout previously noted, the same day the Alameda investment was announced, Moonstone installed Ronald Oliveira as CEO. Oliviera had previously worked for the fintech company Revolut, a “leading digital alternative bank” financed by Jeffrey Epstein associate Nicole Junkermann. Roughly two months later, the bank hired Joseph Vincent as its legal counsel. Immediately prior to joining Farmington/Moonstone, Vincent had served as the general counsel for Washington State’s Department of Financial Institutions and its director of legal and regulatory affairs for 18 years.

Shortly before FTX’s collapse, which put Farmington/Moonstone under heavy scrutiny, Farmington/Moonstone partnered with a relatively unknown company called Fluent Finance. Fluent Finance, both then and now, has evaded scrutiny from the media aside from Unlimited Hangout’s investigation into Farmington, published last December. However, since FTX’s unraveling and the shuttering of Farmington/Moonstone in the months that followed, Fluent Finance has been quite busy, developing significant government partnerships in the Middle East and looking to become a central part of the coming Central Bank Digital Currency (CBDC) paradigm for both West and East.

A likely reason behind the lack of media interest in Fluent Finance and their apparent success after the FTX scandal is the fact that Fluent, from its earliest days, has been operating as an apparent front for some of the most powerful commercial banks in the world and building out “trusted” digital infrastructure for the economy to come. This investigation, an examination of Fluent’s past and its current trajectory, may help elucidate the true motives behind the efforts of Chalopin, Bankman-Fried and others to turn the tiny Farmington State Bank into “Moonstone.”

Fluent Finance’s Deep and Early Connections to Wall Street Banks

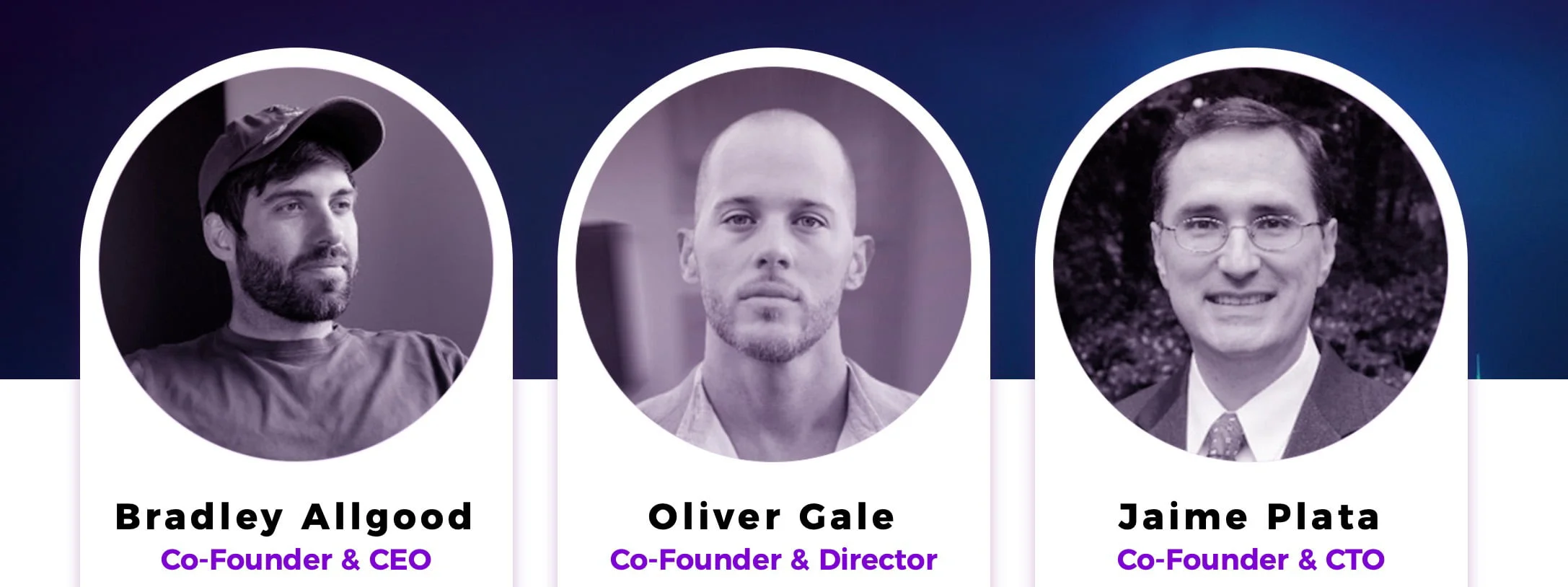

Fluent Finance was created in 2020 and was co-founded by Bradley Allgood, Oliver Gale and Jaime Plata. Allgood began his career with the US Army and later went on to serve in NATO’s Governmental Operations division with an apparent focus on NATO activity in Afghanistan. After leaving NATO, Allgood “immediately jumped” into economic development, specifically the creation and expansion of Special Economic Zones (SEZs), specifically one partnered with the Catawba Indian Reservation in South Carolina. That SEZ, officially named the Catawba Digital Economic Zone, was co-founded by Allgood in 2019 and he still serves as its head of Commercial Banking.

Sitting on just two acres of land, the zone aims to “become the worldwide registration hub for crypto companies” as well as to “take a huge chunk out of Delaware’s market for company registration or even to replace it as the gold standard.” The zone is backed by a venture capital firm tied to Bradley Tusk, the former Deputy Governor of Illinois under disgraced former Governor Rod Blagojevich and the former campaign manager for billionaire Mike Bloomberg. In addition, Tusk’s companies count Google, the Rockefeller Foundation and Ripple (XRP) among their clients. Tusk’s different VC firms have invested in Coinbase and Circle, the issuer of the USDC stablecoin, and Uber as well as the economic zone co-founded by Allgood.

Shortly after leaving the military, Allgood also worked on the early development of digital transformation of governments, digital identities, people and property registries and the tokenization of carbon credits and commodities. Later motivated by “the sheer number of unbanked and underbanked in the world”, Allgood hosted roundtables around the world with central bank “regulators, tier one institutions, innovators, [and] technology providers” and decided he could act as “a good connector” for the different actors in his growing network.

Allgood claims to have spoken to a few “really senior” banking executives at HSBC, Citi and Barclays and to have educated “them on new innovative technologies for custody [and] better digital identity.” After “building a team” of these “senior bankers from tier one financial institutions,” Allgood and his team “went out into the market and started servicing the [cryptocurrency] space and helping innovative companied find homes and large core banking systems and tier one financial institutions.” While working with these various titans of finance and guiding their views on the future of banking, Allgood met his co-founders of Fluent Finance: Oliver Gale and Jaime Plata.

Oliver Gale is one of the co-founders of Central Bank Digital Currencies (CBDCs), having pioneered the first CBDC project in the Eastern Caribbean and, per Allgood, Gale “went on to do them in Nigeria” and helped create the highly controversial e-Naira. Gale notably describes himself as the inventor of CBDCs and has previously collaborated with the UN, MIT and the IMF. Jaime Plata, Fluent’s other co-founder, “did the core banking systems of the Eastern Caribbean Central Bank during the first CBDC [launch].” Aside from Gale and Plata, Allgood has revealed that other top Fluent Finance executives, who are not listed on the company’s website, hail from the Wall Street titan Citi – with the company’s CFO being “the CFO of Citi of all of Latin America” and its COO being “one of the senior, most senior, managing directors from Citi.” He has also stated that other important employees of Fluent include the former chief innovation officer of General Electric as well as “an early board member at [the now collapsed crypto exchange] Celsius [that] helped them get to market.”

Fluent Finance was initially founded with two main and interrelated products: the Fluent Protocol and the US+ stablecoin. Fluent has described the Fluent Protocol as “a financial network that seamlessly bridges traditional finance and digital assets,” while US+ is a “bank-led”, US dollar-pegged stablecoin “built on principles” and designed to be “forward-compatible with CBDC initiatives.” Fluent asserts that US+ resolves “the inherent flaws of web3-native stablecoins” by having US+ be operated by a network of banks partnered with Fluent Finance. Fluent has not made the identities of these banks available to the public.

“When we examined stablecoins, we knew that the lack of institutional uptake of the technology was due to risk,” explained Allgood. “With that in mind, when we approached the design of US+, we did so in terms of de-risking. We knew we needed to provide real-time and transparent reserves monitoring.” Fluent’s answer to providing the reserve metrics needed to tap into the heavily regulated traditional finance market emerged through its partnership with Chainlink, first announced in September 2022.

Chainlink is a blockchain oracle network, meaning it connects blockchains to external systems. It was launched in 2017 on the Ethereum blockchain and later registered in the Cayman Islands as SmartContract Chainlink Limited SEZC in March 2019. In December 2021, the former Google CEO Eric Schmidt, who has unprecedented control over the Biden administration’s technology policies, joined Chainlink Labs as a strategic advisor. At the time, Schmidt commented that “it has become clear that one of blockchain’s greatest advantages — a lack of connection to the world outside itself — is also its biggest challenge.”

Fluent’s partnership with Chainlink dealt with regulatory necessities by providing a reliable way for the Fluent Protocol to access real-time, off-chain data from external sources. Fluent’s goal was/is to provide proof of the size, performance, and risk of its asset reserves in order to meet its stablecoin protocol liquidity requirements. Reliable confirmation and publishing of the state of these reserves was seen as crucial by Allgood and others at Fluent in order to manufacture trust from both retail users and membership banks.

Fluent is far from the only partner of Chainlink working on providing trusted stablecoin reserve architecture. Among them is Paxos, the former issuer of Binance’s BUSD and their own PAX, and who recently began providing infrastructure for PayPal’s PYUSD stablecoin. Paxos relied on Chainlink to provide on-chain Proof of Reserve Data Feeds for Paxos’ assets, ensuring verification that PAX tokens are 1:1 backed by US Dollars. This was taken a step further with their gold-backed PAXG tokens, in which Chainlink claimed to be able to provide verification of off-chain, physical gold bars held in Paxos’ custody.

Another Chainlink partner is the XinFin Network, also known as the XDC network, which uses Chainlink’s Price Reference Data framework to introduce price feeds for major national currencies such as the Hong Kong Dollar, the Singaporean Dollar, and the United Arab Emirates Dirham. In October 2022, Fluent Finance announced a partnership with Impel to bring its US+ stablecoin to the XDC network. Impel itself is a startup birthed out of XinFin Fintech led by CEO and founder Troy S. Wood. The company boasts a team of advisors including XDC Network co-founders Ritesh Kakkad and Atul Khekade, in addition to long time SWIFT employee André Casterman.

In March 2021, XinFin leveraged the DASL Crypto Bridge designed by LAB577 to bring their XDC token to R3’s Corda blockchain. R3 began as a consortium of banks and is not only closely connected to Fluent Finance, but, as will be discussed shortly, is also a major driver of CBDC and stablecoin development globally. Before this XDC-Corda bridge was created, there was no liquidity or token of value on the R3 Corda Network. This bridge opened up the opportunity for traditional financial institutions, such as those that fund R3, to interact with cryptocurrency indirectly without having to operate on under-regulated public networks that could land them in hot water with regulators. It also gives access to those already utilizing Ethereum-based tokens (i.e. ERC20 or ERC721) to the business networks and financial institutions on the Corda network.

XDC co-founder and Impel advisor Atul Khekade remarked that the both government regulators and commercial banks had settled on XDC and Corda as the means through which many major banks would access blockchain technologies: